rheapawsey1626

About rheapawsey1626

Understanding Line of Credit Score Loans With No Credit Check

In today’s monetary landscape, entry to credit is essential for a lot of individuals and businesses. A line of credit score loan with no credit check offers an alternative financing option for individuals who might battle to qualify for traditional loans due to poor credit history. This text will explore what a line of credit score is, how it really works, the advantages and risks related to no credit check loans, and tips for managing this kind of financing responsibly.

What’s a Line of Credit score?

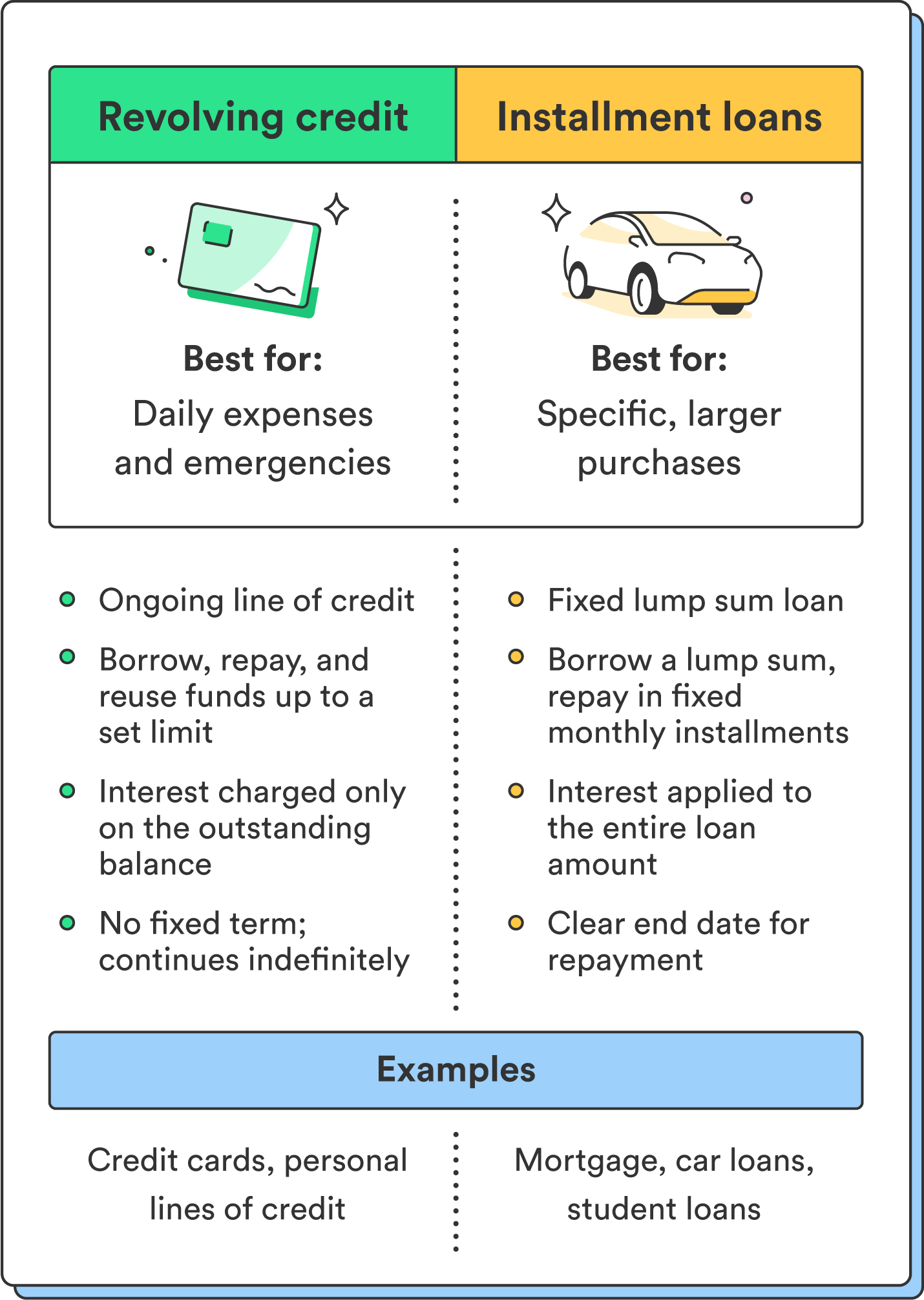

A line of credit score is a versatile loan option that permits borrowers to access a specified quantity of funds at any time. Not like traditional loans, where you obtain a lump sum and repay it in mounted installments, a line of credit score supplies you with a credit score limit which you could draw from as wanted. You solely pay interest on the amount you withdraw, making it a versatile financial device for managing money move, emergencies, or unexpected expenses.

How Does a Line of Credit Work?

Once you apply for a line of credit, the lender will evaluate your financial scenario, together with earnings, employment history, and existing debts. In the case of a no credit check line of credit, lenders might not assess your credit score rating, which could make it simpler for individuals with poor credit to qualify. Once authorised, you’ll receive a credit score limit which you could entry at any time.

You’ll be able to withdraw funds as much as your credit score limit as needed, and you will only incur interest on the amount you use. Funds could be made monthly, and as you repay the borrowed amount, your accessible credit replenishes, permitting you to borrow once more in the future. This revolving nature of a line of credit score makes it a versatile possibility for managing ongoing monetary needs.

Advantages of Line of Credit Loans with No Credit Check

- Accessibility: One of the most significant advantages of a no credit check line of credit score is that it opens doors for individuals with poor credit score or limited credit history. If you have any concerns pertaining to where and how you can use www.bestnocreditcheckloans.com, you can call us at our web-site. Traditional lenders usually rely heavily on credit score scores, which can exclude many potential borrowers. A no credit check choice permits extra folks to entry funds when wanted.

- Flexibility: A line of credit offers flexibility in borrowing. You’ll be able to withdraw funds as needed, making it perfect for managing cash flow, masking unexpected bills, or financing quick-term tasks without the need for a long-term commitment.

- Curiosity on Utilized Quantity: Not like traditional loans the place you pay interest on the complete quantity borrowed, with a line of credit score, you only pay curiosity on the funds you truly withdraw. This will result in lower overall interest costs if managed correctly.

- Revolving Credit: As you repay the borrowed quantity, your out there credit score replenishes, permitting you to borrow once more with out having to reapply. This may present a steady security internet for emergencies or ongoing monetary needs.

Risks of Line of Credit Loans with No Credit Check

- Greater Interest Charges: No credit check loans usually come with larger interest rates in comparison with traditional loans. Lenders might cost a premium for the elevated danger they take on by lending to individuals with poor credit score. It’s important to know the phrases and circumstances before borrowing.

- Potential for Over-Borrowing: The flexibleness of a line of credit score can lead some borrowers to withdraw more than they will afford to repay. This can create a cycle of debt if not managed rigorously, leading to monetary pressure.

- Fees and Expenses: Some lenders could impose charges for setting up the road of credit, upkeep charges, or fees for late payments. It’s essential to read the fantastic print and perceive all potential prices associated with the loan.

- Influence on Financial Well being: While a line of credit can provide quick access to funds, relying too heavily on this type of financing can negatively affect your monetary health. It’s important to have a plan for repayment and to use the credit responsibly.

Tips for Managing a Line of Credit score Responsibly

- Set a Finances: Earlier than using a line of credit score, create a budget that outlines your earnings, bills, and how much you possibly can afford to borrow and repay. Stick with this price range to keep away from overspending.

- Use Only What You Need: Only withdraw the quantity you genuinely want. This can assist minimize curiosity prices and keep your debt manageable.

- Make Payments on Time: Timely funds are essential for maintaining a very good relationship along with your lender and avoiding late fees. Set reminders or automate funds to ensure you never miss a due date.

- Monitor Your Credit score Usage: Keep observe of how much credit score you’re utilizing and how much is offered. This will enable you to stay aware of your monetary situation and stop over-borrowing.

- Have a Repayment Plan: Before borrowing, have a transparent plan for the way you’ll repay the quantity borrowed. This may provide help to keep away from falling into a cycle of debt and ensure you may meet your obligations.

Conclusion

A line of credit score loan with no credit check could be a helpful monetary software for those in need of flexible funding options. While it offers accessibility and comfort, it is important to know the associated risks and manage the credit score responsibly. By following sound monetary practices, borrowers can take advantage of a line of credit score while avoiding potential pitfalls. As with every financial product, cautious consideration and planning are key to reaching monetary stability and success.

No listing found.