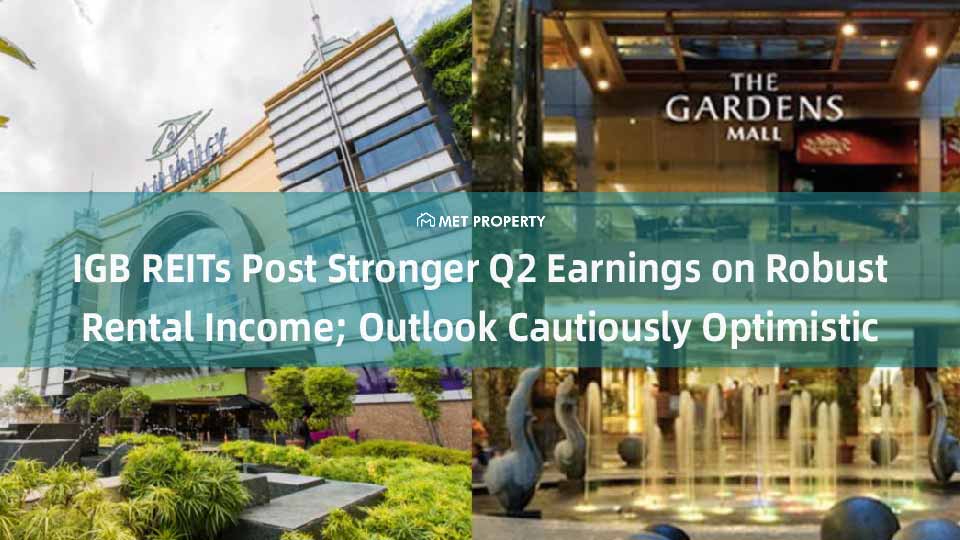

“IGB REIT and IGB Commercial REIT report higher Q2 earnings driven by strong rental income. Both REITs declare August distributions as they navigate economic headwinds.”

Kuala Lumpur, 30th July 2025, 01.50pm – IGB Real Estate Investment Trust (IGB REIT) and IGB Commercial REIT (IGBCR) recorded solid second-quarter earnings, driven by higher rental income and stable operating costs, according to their latest financial disclosures to Bursa Malaysia.

IGB REIT, which owns prominent retail assets such as Mid Valley Megamall and The Gardens Mall, saw its net property income (NPI) rise 9.5% to RM119.86 million for the quarter ended June 30, 2025 (2QFY2025), compared to RM109.48 million in the same period last year. Revenue increased 6.8% year-on-year to RM160.09 million, mainly attributed to stronger rental performance.

The trust also declared a distribution per unit (DPU) of 2.82 sen, payable on August 28.

Meanwhile, IGB Commercial REIT, which holds a portfolio of office buildings, reported a 10.5% growth in NPI to RM38.06 million, up from RM34.45 million in 2QFY2024. Revenue rose 12.7% to RM64.59 million, bolstered by improved occupancy rates and higher average rents. The REIT declared a DPU of 1.03 sen, also payable on August 28.

Outlook Remains Cautiously Optimistic

Looking ahead, IGB REIT acknowledged the potential impact of weaker consumer spending amid persistent cost pressures on retailers. However, the trust remains optimistic, buoyed by the proposed acquisition of The Mall, Mid Valley Southkey, which is expected to enhance portfolio value and rental yield.

IGB Commercial REIT, on the other hand, flagged headwinds from rising business costs, including the expanded sales and service tax (SST) and electricity tariff hikes, which may place downward pressure on rental reversions in the coming quarters.

Despite external challenges, both REITs continue to benefit from stable income streams and prime asset locations, reinforcing their resilience in Malaysia’s real estate investment trust sector.